Study Shows that overall Household Wealth in the UK has Risen by 4.5% pa Since 2008

Two recent studies carried out by the Centre of Economics and Business Research (CEBR) and the Wealth and Asset Survey (May 2017) show that overall household wealth in the UK has risen by an average of 4.5% a year since 2008 from £8.5 trillion to £11.5 trillion. Households which have over £1 Million in assets have seen the main contributor coming from pension assets rather than property. This is due to generally buoyant equity markets which has outstripped property growth of 3.0% a year over the same period. So, if you have combined wealth of £1.1 million or more you are in the top 10% of the wealthiest people in the UK.

Breakdown

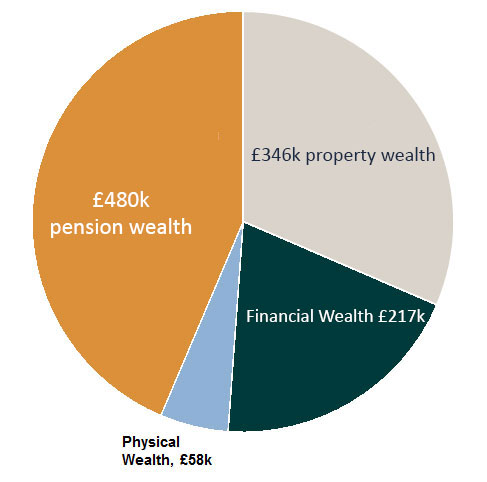

The financial breakdown of this group of people works out as follows;

Property Wealth & Pension Wealth

Property wealth and pension wealth are the two biggest contributors to household wealth across all of the UK regions. Also, but necessarily associated with the wealthy, ISA’s have also seen a large increase in value, and with the annual allowance now sitting at £20,000 pa per individual, is likely to rise still further.

In fact, this increase in wealth is also pushing more people into the inheritance tax (IHT) trap, and coupled with the significant element of pension wealth accumulated does increase the need to plan wisely, and to seek advice.

If you would like advice and guidance on pensions, investments, or IHT planning please call us on 01273 208813

or email [email protected] and we would be happy to assist you.

For more financial information like this and to sign up for our newsletter please click here

Read some of our other stories:

Life Insurance comes in many forms

Key Information About Inheritance Tax

Life Insurance what you need to know!

IEP Financial is authorised and regulated by The Financial Conduct Authority (FCA)

This article was originally published on Friday, June 2nd, 2017

The value of investments can fall as well as rise and past performance is not a guide to the future. The content of this publication is for information only. It does not represent personal advice or a personal recommendation, and should not be interpreted as such. Please do not act upon any part of it without first having consulted an Independent Financial Advisor.